Only at NAR Convention can you hear from a panel of FEMA representatives about the National Flood Insurance Program (NFIP) and have questions answered. They discussed the NFIP, the rate increases, and what can be done to mitigate those increases for your customers and clients.

The Speakers

- Kristin Cormier Robinson, Senior Advisor to the Associate Administrator, Federal Insurance and Mitigation Administration, FEMA

- Ed Connor, Deputy Associate Administrator, Insurance, Federal Insurance and Mitigation Administration, FEMA

- Roy Wright, Deputy Associate Administrator, Mitigation, Federal Insurance and Mitigation Administration, FEMA

- Jordan Fried, Associate Chief Counsel, Federal Insurance and Mitigation Administration, FEMA

- Thomas Hayes, Chief Actuary, Federal Insurance and Mitigation Administration, FEMA

Now that’s a panel. And they had plenty to say, some of which you may already have heard before.

Beginning January 1 of 2013, non-primary properties in specific hazard zones were subject to a 25% premium rate increase and will continue to see rate increases each year until their premium equals the full actual amount they should pay. No more subsidies.

Beginning October 1 of 2013, commercial properties in the same zones were subject to the same rate increases.

For anyone else who receives subsidies, there are 3 triggers which cause a premium rate increase in full – meaning there’s no gradual increase:

- Lapse in coverage

- Number of severe repetitive losses of the property

- Exchanging ownership

That last one has the most affect on Realtors.

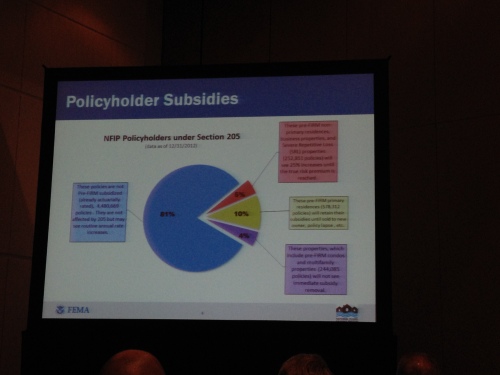

The reality, the panel said, is much different than the worry. Nationwide, there are 5.6 million NFIP policy holders – 81% of them will not be affected.

You may have to zoom in to see the fine print. That big blue section represents the people who won’t be affected by the large rate increases. They will see typical rate increases as with any kind of insurance.

Note: part of the Biggert-Waters Act of 2012 (with the NFIP reforms) requires that a reserve fund be created and funded. Five percent of premiums will go into this fund. All policy holders will see rate increases that reflect this requirement.

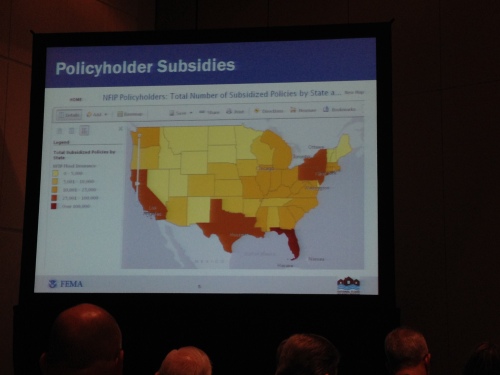

The panel also pointed out that the nation is not all affected the same by the NFIP rate increases. They went on to say that the affects are different from county to county within a state, including Florida. But, Florida is the most affected state in the country as you can see by the picture below.

The reason behind the majority of the changes is because the NFIP is no longer sustainable without rate increases. Hurricanes Katrina and Sandy were the two costliest storms for the NFIP. In 2012, for the first time, the NFIP had to borrow money from the U.S. Treasury and now owes $24 billion. If storms continue to hit the U.S. in the same frequency or severity, the NFIP will not be able to sustain itself.

Part of the Biggert-Waters Act requires FEMA to make sure that communities and citizens have an understanding of their flood risk and how to mitigate that risk. They have a specific message to homeowners who may experience a rate increase. Homeowners should do these things:

- Talk to their insurance agent

- Order an elevation certificate

- Consider a higher deductible

- Build or rebuild their home higher

- Community-wide mitigation – there are things a city can do that will result in rate discounts for everyone in their community.

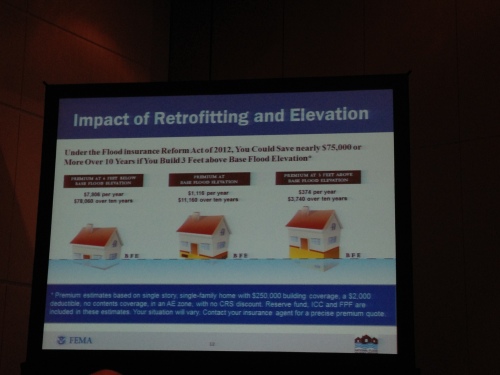

With regard to building or rebuilding their home with a higher elevation, consider this:

If you can’t read this, let me share the details. Assuming a home is a single story, single-family home with $250,000 in coverage, a $2,000 deductible and OTHER fine print in that picture above, here are estimates of what the insurance premiums could be:

- A home that is 4 feet below base flood elevation will have a flood insurance premium of about $7,806 per year or $78,060 over 10 years.

- A home that is at base flood elevation will have a flood insurance premium of about $1,116 per year or $11,160 over 10 years.

- A home that is 3 feet above base flood elevation will have a flood insurance premium of about $374 per year or $3,740 over 10 years.

A lot of information was shared in a short amount of time at this meeting. This only scratches the surface. For more information about NFIP and the changes affecting property owners, here are a list of resources that the panel provided:

There are things that can be done by property owners to help mitigate the rate increases they may see. The advice the panel gave most often was for owners to get an elevation certificate. This will show the exact elevation of the property even though it may be in a flood zone. The panel emphasized that inches can make a difference.

For more information, check out the NAR website (www.Realtor.org) or the Florida Realtors Flood Insurance Toolkit.

As ECAR learns more information, we will share it with you!

~Michaela Mitchell, ECAR Communications Director